How to Form an LLC in California – The Ultimate 2025 Step-by-Step Guide

So, you’re thinking about starting a business in the Golden State? Awesome! California offers incredible opportunities, but navigating the legal stuff can feel like a maze. If you’re wondering how to form an LLC in California, you’ve come to the right place.

Forming a Limited Liability Company LLC is a super popular move for entrepreneurs, offering a sweet spot between liability protection and operational flexibility. This guide, fully updated for 2025, will cut through the red tape and give you the clear, step-by-step instructions you need to get your California LLC up and running smoothly. Let’s dive in!

What Exactly is a California LLC

Before we get down to brass tacks, let’s quickly cover what an LLC actually is. Think of it as a hybrid business structure. It combines the liability protection typically associated with corporations with the pass-through taxation and operational ease often found in sole proprietorships or partnerships. It’s a distinct legal entity, separate from its owners (called members.

Benefits of a CA LLC Liability Shield, Tax Perks, Credibility

Why jump through the hoops to form an LLC? The advantages are pretty compelling for many business owners. For a deeper dive, explore these LLC CALIFORNIA benefits in more detail, but here’s the gist:

Protecting Your Personal Stash – Liability Explained

This is the big one. Personal liability protection means that if your business incurs debts or faces a lawsuit, your personal assets like your house, car, or personal savings are generally protected. The business is responsible for its own obligations, not you personally provided you maintain the LLC properly and don’t engage in fraudulent activity. This “corporate veil” is a massive stress reliever for entrepreneurs.

Tax Talk – Pass-Through Taxation Simplicity

By default, LLCs are typically treated as “pass-through” entities for federal tax purposes. This means the LLC itself doesn’t pay federal income taxes. Instead, the profits or losses “pass through” to the owners (members), who report them on their personal income tax returns IRS Form 1040. This avoids the “double taxation” sometimes faced by traditional C-corporations, where profits are taxed at the corporate level and again when distributed to shareholders as dividends. California does impose its own taxes like the franchise tax we’ll discuss, but the federal pass-through status is a significant plus.

Credibility Boost

Operating as an LLC can make your business appear more established and professional to clients, suppliers, and potential partners compared to operating as a sole proprietor. Having “LLC” after your business name adds a layer of legitimacy.

Potential Downsides The $800 Tax & State Rules

It’s not all sunshine and roses. Forming and maintaining a California LLC comes with specific responsibilities and costs:

Understanding the Annual Franchise Tax $800 Minimum

This is a crucial point for California. Nearly every LLC registered or doing business in the state must pay a minimum Annual Franchise Tax of $800 per year to the Franchise Tax Board FTB. This applies even if your LLC isn’t making money or isn’t actively operating. It’s a fixed cost of doing business as an LLC in CA.

Note: A temporary first-year waiver under AB85 expired, so the $800 is due starting from your first year as of 2024/2025.

Navigating California’s Compliance Landscape

California has specific rules and compliance requirements for LLCs, including regular filings like the Statement of Information. Staying on top of these deadlines and requirements is essential to keep your LLC in good standing with the state.

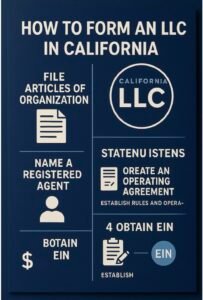

Your Point Person – Appointing a Registered Agent

Every California LLC must designate a Registered Agent, officially known as an Agent for Service of Process. This isn’t just paperwork filler; it’s a crucial legal requirement.

What’s an Agent for Service of Process? Their Job

Your registered agent is the designated recipient for official legal documents, state correspondence, and service of process notice of a lawsuit on behalf of your LLC. They must have a physical street address in California P.O. Boxes generally don’t count and be available during standard business hours to receive these important documents. Think of them as your LLC’s official point of contact with the state and the legal system.

Agent Requirements in California Who Qualifies?

Your agent can be an individual California resident including yourself, a member, or an employee, as long as they meet the requirements or a corporation registered with the SOS as a commercial registered agent service. If an individual, they must be at least 18 years old and physically present at the listed California address during business hours.

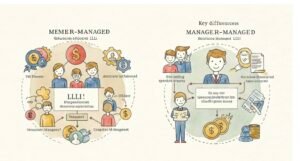

Who’s the Boss? Member-Managed vs. Manager-Managed LLCs

You need to decide on your LLC’s Management Structure. How will the company be run day-to-day?

Member-Managed LLC

This is the default structure in California if you don’t specify otherwise. In a member-managed LLC, all the owners members participate directly in the daily operations and major decision-making of the business. It’s common and practical for smaller LLCs where the owners are all actively involved in running the show.

Manager-Managed LLC

Alternatively, you can opt for a manager-managed LLC. Here, you designate one or more managers to handle the business operations. These managers can be members themselves, or they can be non-members hired for the role. This structure might be chosen if some members are passive investors, if the LLC is large and needs a more formal management hierarchy, or if the members prefer to delegate operational control. This structure must be specified in your Articles of Organization and detailed in your Operating Agreement.

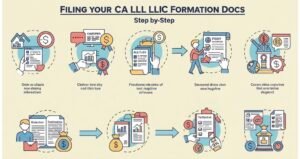

Alright, is the checklist complete? Time to make it official! Filing the paperwork isn’t as daunting as it sounds, especially with the state’s online portal.

Step 1 – File Articles of Organization Form LLC-1 with the SOS

This is the key formation document that legally creates your California LLC. Once the SOS approves this form, your LLC officially exists.

Info Needed for the Form LLC-1

You’ll need to provide the following information accurately:

- Your chosen and available LLC name exactly as you want it registered.

- The LLC’s purpose a general statement like “to engage in any lawful act or activity for which a limited liability company may be organized under California law” is usually sufficient and recommended.

- The name and California street address of your designated Registered Agent.

- The LLC’s initial principal executive office address this can be in CA or elsewhere.

- An indication of whether the LLC will be member-managed or manager-managed.

- The signature of the LLC organizer the person submitting the form; doesn’t have to be a member or manager.

Filing Options: bizfile Online, Mail, Walk-In

- Online: The easiest and generally fastest method is filing electronically through the SOS’s bizfile Online portal. You create an account, fill out the form online, and pay the fee electronically.

- Mail: You can download Form LLC-1 from the SOS website, fill it out, and mail it with a check or money order for the filing fee to the SOS office in Sacramento.

- In-Person: You can also deliver the completed form and payment in person to the Sacramento office. Note that in-person submissions often require an additional handling fee.

The Filing Fee – $70 2025 Rate

As of 2025, the state filing fee for the Articles of Organization is $70. This is a one-time fee paid directly to the Secretary of State when you submit the form.

Step 2 – Draft Your LLC Operating Agreement

While not legally required to be filed with the state, creating an LLC Operating Agreement is highly recommended and a crucial internal document for all LLCs, even a Single-Member LLC SMLLC. Don’t skip this!

Why Even Solo Riders Need One Importance

This internal document acts as the customized rulebook for your LLC. It outlines critical details like ownership percentages member interests, member/manager roles and responsibilities, how profits and losses will be allocated and distributed, voting rights, procedures for handling key events like adding or removing members, transferring ownership, and dissolving the LLC.

What Goes In It? Key Clauses

Common provisions include: member names and addresses, capital contributions initial investments, profit/loss allocation methods, distribution schedules/policies, management structure details roles, powers, voting procedures, meeting requirements if any, buy-sell provisions what happens if a member leaves/dies, and dissolution procedures.

DIY Template vs. Lawyer-Drafted

You can find many templates online some free, some paid. For very simple, single-member LLCs, a well-vetted template might suffice. However, for multi-member LLCs or LLCs with complex arrangements, consulting with a business attorney to draft a custom Operating Agreement is often a wise investment. A custom agreement tailored to your specific situation can prevent costly misunderstandings and disputes down the road.

Step 3 – Your EIN from the IRS

An Employer Identification Number EIN. also known as a Federal Tax Identification Number, is essentially a Social Security number for your business used by the IRS.

What’s an EIN & Do You Need It?

You’ll definitely need an EIN if your LLC:

- Will hire employees.

- Is a multi-member LLC taxed as a partnership by default.

- Elects to be taxed as a corporation S-corp or C-corp.

- Needs to open a business bank account most banks require one, even for SMLLCs.

- Files certain excise or alcohol, tobacco, and firearms tax returns.

Even if not strictly required like for some SMLLCs with no employees, getting an EIN is generally a good idea for opening bank accounts and establishing your business’s separate identity.

Applying Online for Free IRS Website

Getting an EIN is straightforward and completely free directly from the IRS website. The online application process is quick and easy, usually providing your EIN immediately upon completion. Be extremely wary of third-party websites that charge a fee for obtaining an EIN there’s no need to pay for this government service. You typically need to wait until your LLC is officially formed Articles of Organization approved by the SOS before applying for your EIN.

California LLC FAQs

Let’s tackle some frequently asked questions:

How long does CA LLC formation take?

Using the bizfile Online portal, approval of your Articles of Organization often takes just a few business days. Filing by mail can take several weeks. Don’t forget the 90-day window after formation to file your initial Statement of Information.

Can I be my own registered agent in California?

Yes, if you meet the requirements: you are a California resident aged 18 or older, have a physical street address not a P.O. Box in California, and are available at that address during normal business hours to accept legal documents.

Is an Operating Agreement required for a single-member LLC?

California law does not require SMLLCs to file an Operating Agreement with the state. However, having a written agreement is strongly recommended even for SMLLCs to demonstrate business formality, reinforce liability protection, and outline how the business will operate.

What if I miss the Statement of Information deadline?

The California Secretary of State can assess a $250 late filing penalty. More importantly, failure to file your initial or biennial Statement of Information can lead to your LLC’s status being suspended by the Franchise Tax Board, which means it loses the right to conduct business legally in California and its name becomes available. Get those filings in on time!

Can I change my sole proprietorship to an LLC?

Yes. You essentially form a new LLC by filing Articles of Organization with the SOS. You would then typically transfer any relevant assets and contracts from your sole proprietorship to the new LLC consult professionals on this process. You can usually continue using the same EIN if you already had one as a sole proprietor with employees.

Essential Resources & Next Steps

You’re now armed with a solid understanding of how to form an LLC in California! Remember to leverage these official resources:

- California Secretary of State SOS: sos.ca.gov/business-programs/business-entities Find forms like Form LLC-1 & Form LLC-12, search businesses, access bizfile Online

- Franchise Tax Board FTB: ftb.ca.gov Info on the Annual Franchise Tax & LLC Fee, payment options, forms like FTB Form 3522

- Internal Revenue Service IRS: irs.gov Apply online for your EIN

- CalGold Business Permits: www.calgold.ca.gov Identify required federal, state, and local licenses/permits

- Small Business Administration SBA: sba.gov General business planning resources, counseling, and support

Forming an LLC is a significant and exciting step toward building your California dream. It requires careful planning and ongoing attention to compliance. By following these steps diligently and staying informed about your obligations, you can establish a solid legal foundation for your business, enabling you to operate with confidence and benefit from the crucial liability protection that a California LLC provides. Now go make it happen!